LUMAX Industries | Q4FY19

May 18, 2019

LUMAX Industries

BUY

CMP

`1402

Target Price

`2000

Y/E March (` cr)

Q4FY19

Q4FY18

% yoy Q3FY19

% qoq

Investment Period

12 Months

Net sales

433

559

-23%

432

0%

EBITDA

31

45

-32%

37

-18%

EBITDA margin (%)

7.1%

8.1%

-100

8.7%

-57

Stock Info

PAT

14

16

-11.6%

38

-62%

Sector

Auto-Ancillary

Market Cap (` cr)

1,311

Beta

1.3

For Q4FY2019, Lumax Industries Ltd. (LIL) registered 23% de-growth on yoy basis

52 Week High / Low

2400/1386

on the revenue front to `433cr (including mould income `14.66cr) as compared to

Avg. Daily Volume

7,135

Face Value (`)

10

`559cr (including mould income `108cr). Adjusted revenue saw de-growth of 7.1%

BSE Sensex

37,930

Nifty

11,407

yoy to `418cr vs. `450cr in same quarter last year. The decline in revenue was

Reuters Code

LUMA.BO

majorly due to slowdown in industry growth and mould sales. Operating margin

Bloomberg Code

LUMX IN

also decreased by 110bps to 7.1% due to lower realization. For FY2019, margins

have improved slightly from 8.11% to 8.27%.

Shareholding Pattern (%)

During the quarter LIL has added two new models in 2-wheeler segments i.e.

Promoters

75.0

Maestro refresh and Xpulse.

MF / Banks / Indian Fls

1.2

FII / NRIs / OCBs

0.7

Stable LED contribution a cause of concern: Share of LED for the quarter under

Indian Public / Others

23.1

review came in at 33% which was similar to that of previous quarter. However, it

has improved from 25% in FY2017 to 33% in FY2019. Management expects it to

remain same in FY2020E, but it will grow gradually over 50% in coming years

Abs.(%)

3m

1yr

3yr

owing to regulatory changes, which may favor adoption of LED lightening in newer

Sensex

3.4

6.9

28.2

vehicles.

LUMAXIND

(11.1)

(39.0)

331.0

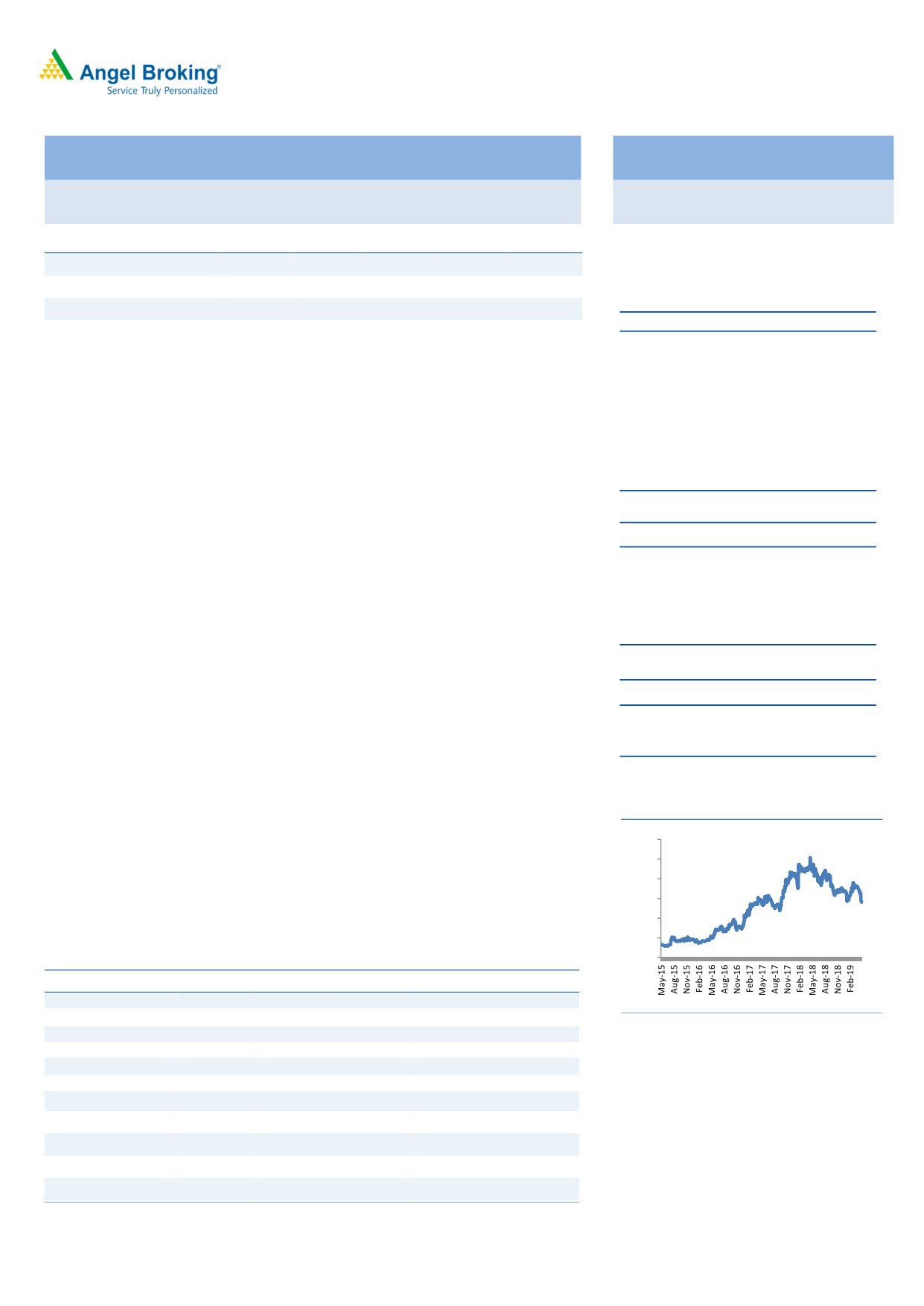

Outlook and Valuation: Near term outlook looks tough for the industry, however

considering the long term perspective, LIL is a good bet to play on auto growth and

3 Years Performance charts

increasing LED penetration, which will help Lumax to grow above the industry rate

3000

going forward. At the CMP of `1,402 stock is available at 12x of FY21E EPS of

2500

`118. Given the near term slowdown in the sector, we have reduced our Target

2000

1500

Price from

`2,150 to `2,000 and recommend BUY on Lumax Industries with

1000

potential upside of 43% over the next 9-12 months.

500

Exhibit 1: Key Financials

0

Y/E March (` cr)

FY17

FY18

FY19

FY20E

FY21E

Net Sales

1,271

1,650

1,851

1,944

2,333

% chg

1

30

12

5

20

Source: Capitaline Angel Research

Net Profit

54

58

104

95

110

% chg

4

7

79

(8)

16

EBITDA (%)

7.9%

8.2%

8.3%

9.6%

9.0%

EPS (Rs)

58

62

111

102

118

P/E (x)

24

23

13

14

12

P/BV (x)

4.2

3.6

3.0

2.6

2.2

Kripashankar Maurya

RoE (%)

17.6

16.0

23.9

18.7

18.3

022 39357600, Extn: 6004

RoCE (%)

15.2

18.7

16.2

20.0

20.0

EV/EBITDA

13.7

10.3

9.2

7.5

6.6

Source: Company, Angel Research; Note: CMP as of May 17, 2019

May 18, 2019

1

LUMAX Industries | Q4FY19

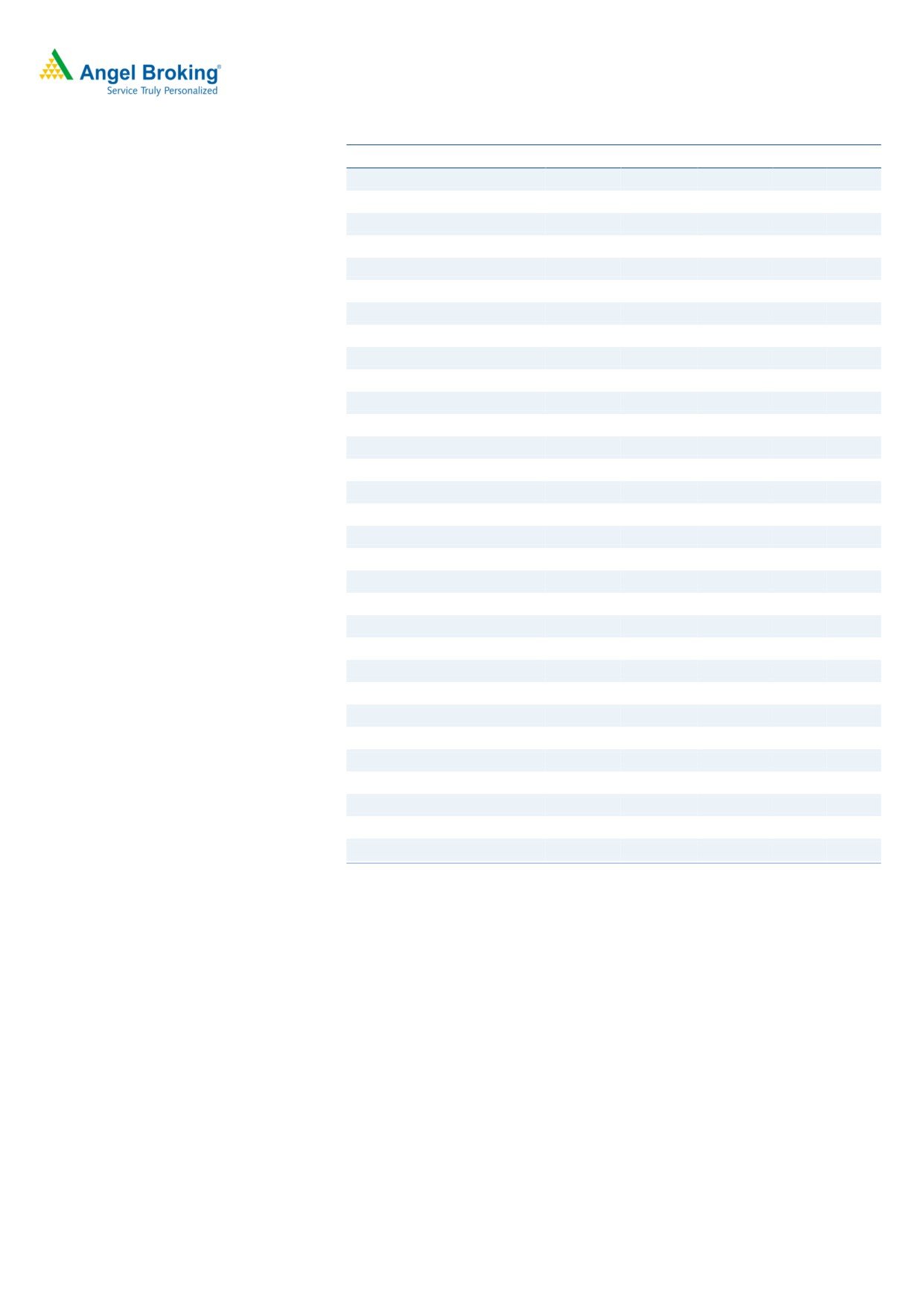

Exhibit 1:

In Cr

Q4FY19

Q4FY18

Q3FY19

YOY %

QOQ%

Net Sales

433

559

432

-23%

0%

Total Income

433

559

432

-23%

0%

Total Expenditure

402

514

395

-22%

2%

Raw Material Consumed

271

276

282

-2%

-4%

Stock Adjustment

7.16

-3.10

-5.72

NA

NA

Purchase of Finished Goods

5.13

19.87

3.93

-74%

31%

COGS

283

293

280

-3%

1%

Employee Expenses

53

53

55

1%

-4%

Other Expenses

65

168

59

-61%

9%

As a % of sales

Raw Material Consumed

63%

49%

65%

Stock Adjustment

2%

-1%

-1%

Purchase of Finished Goods

1%

4%

1%

COGS

66%

52%

65%

Gross Margin %

34%

48%

35%

Employee Expenses

12%

9%

13%

Other Expenses

15%

30%

14%

EBITDA

31

45

37

-32%

-18%

Other Income

8.75

1.04

1.30

741%

573%

Exceptional Iteam

0.00

0.00

36.20

Profit from Associate

2.54

-1.17

1.58

NA

NA

Interest

4.58

3.64

4.19

26%

9%

PBDT

37.45

41.53

72.36

-10%

-48%

Depreciation

18.96

20.96

20.96

-10%

-10%

PBT

18.49

20.57

51.40

-10%

-64%

Tax

4.24

4.45

13.45

-5%

-68%

PAT

14.3

16.1

37.9

-12%

-62%

Ratios

BPS

BPS

EBITDA margin (%)

7.10%

8.10%

8.67%

-100

-157

PAT margin %

3.29%

2.88%

8.78%

41

-549

Tax rate %

22.91%

21.64%

26.16%

128

-325

Source: Company, Angel Research

Key con call highlights

For Q4FY2019, Lumax Industries Ltd. (LIL) registered 23% de-growth on

yoy basis on the revenue front to `433cr (including mould income

`14.66cr) as compared to `559cr (including mould income `108cr).

Adjusted revenue saw de-growth of 7.1% yoy to `418cr vs. `450cr in

same quarter last year.

The decline in revenue was majorly due to slowdown in industry growth

and mould sales. Operating margin also decreased by 110bps to 7.1%

due to lower realization.

For FY19, operating margins have improved slightly from 8.11% in FY18

to 8.27%.

Management expects similar kind of profit from associate in FY2020 and

5-8% revenue growth during same period on consolidated basis.

May 18, 2019

2

LUMAX Industries | Q4FY19

However, it expects H1FY2020 to witness negative growth and expect

positive momentum from H2FY2020 onwards

During the year, LIL has made exceptional gain of `36.2cr by selling land

and building.

Total capex for FY20 is guided around `50-60cr as regular capex and

around `75cr for Bawal plant expansion.At current level, overall utilization

is at~75%.

Management expects double digit margin trajectory in FY2020E owing to

in-house sourcing of PCB material.

Valuation

Near term outlook looks tough for the industry, however considering the long term

perspective, LIL is a good bet to play on auto growth and increasing LED

penetration, which will help Lumax to grow above the industry rate going forward.

At the CMP of `1,402 stock is available at 12X of FY21E EPS of `118. Given the

near term slowdown in the sector, we have reduced our Target Price from `2,150

to `2,000 and recommend BUY on Lumax Industries with potential upside of 43%

over the next 9-12 months.

Risks to our estimates

Slower than expected adoption of LED lights by OEMs and higher content of

import raw material pose a downside risk to target revenue and net income

respectively.

Faster growth in PV and 2W segments pose an upside risk to target revenue.

May 18, 2019

3

LUMAX Industries | Q4FY19

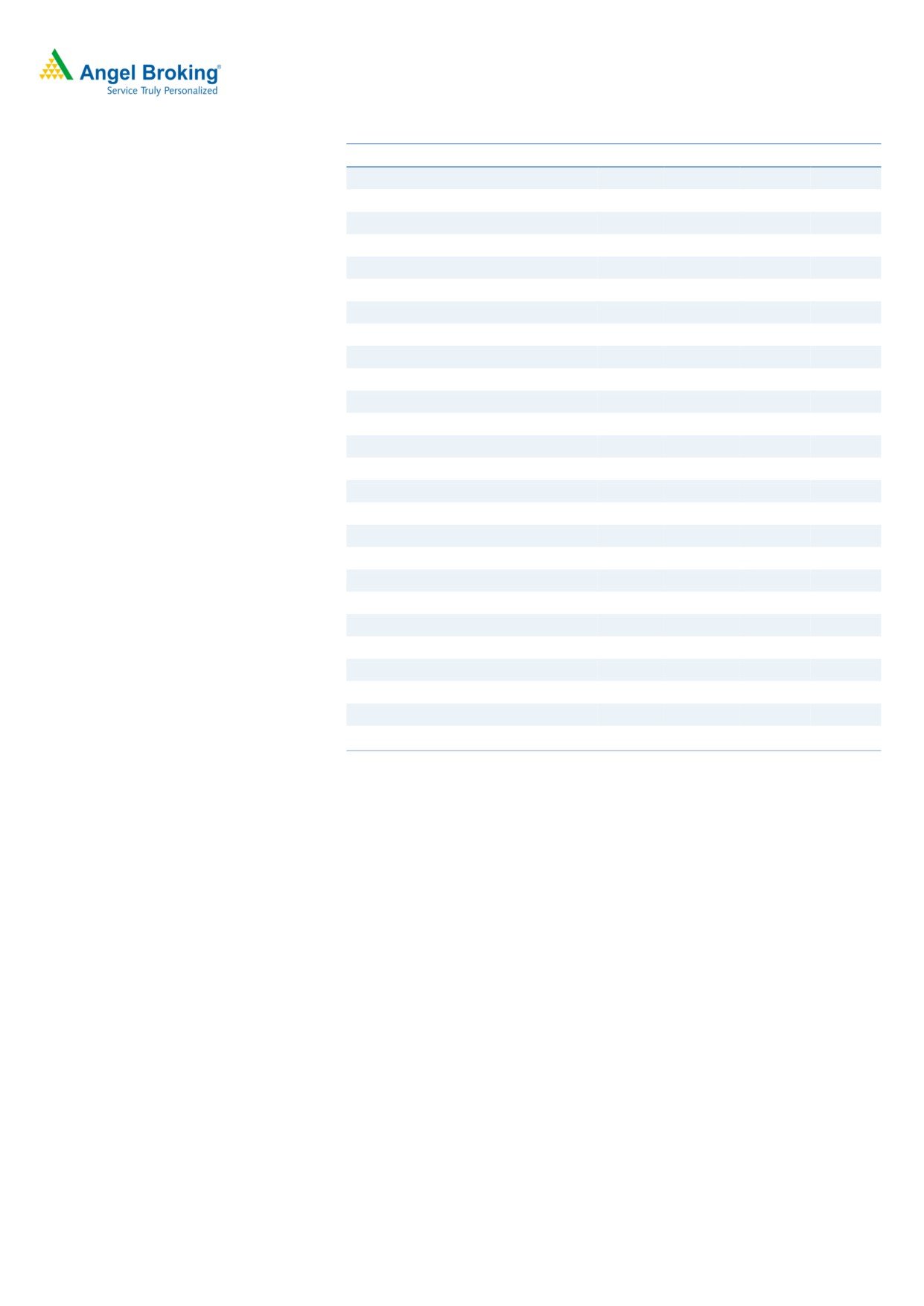

Income statement

Y/E March (` cr)

FY18

FY19

FY20E

FY21E

Total operating income

1,650

1,851

1,944

2,333

% chg

30

12

5

20

Total Expenditure

1,515

1,698

1,758

2,123

Raw Material

1,104

1,183

1,229

1,470

Personnel

189

218

204

257

Selling and Administration Expenses

107

-

-

-

Others Expenses

115

298

325

397

EBITDA

135

153

186

210

% chg

34

13

21

13

(% of Net Sales)

8.2%

8.3%

9.6%

9.0%

Depreciation& Amortisation

48

60

63

68

EBIT

87

93

123

142

% chg

46

7

32

16

(% of Net Sales)

5

5

6

6

Interest & other Charges

8

16

16

16

Other Income

5

12

13

14

Extraordinary Items

-

36

Profit/Loss of Associate Company

13

9

9

9

Recurring PBT

98

134

129

149

% chg

51

38

(4)

16

Tax

26

30

34

39

PAT (reported)

71

104

95

110

% chg

31

45

(8)

16

(% of Net Sales)

4.3

5.6

4.9

4.7

Basic & Fully Diluted EPS (Rs)

62

111

102

118

% chg

7

79

(8)

16

Source: Company, Angel Research

May 18, 2019

4

LUMAX Industries | Q4FY19

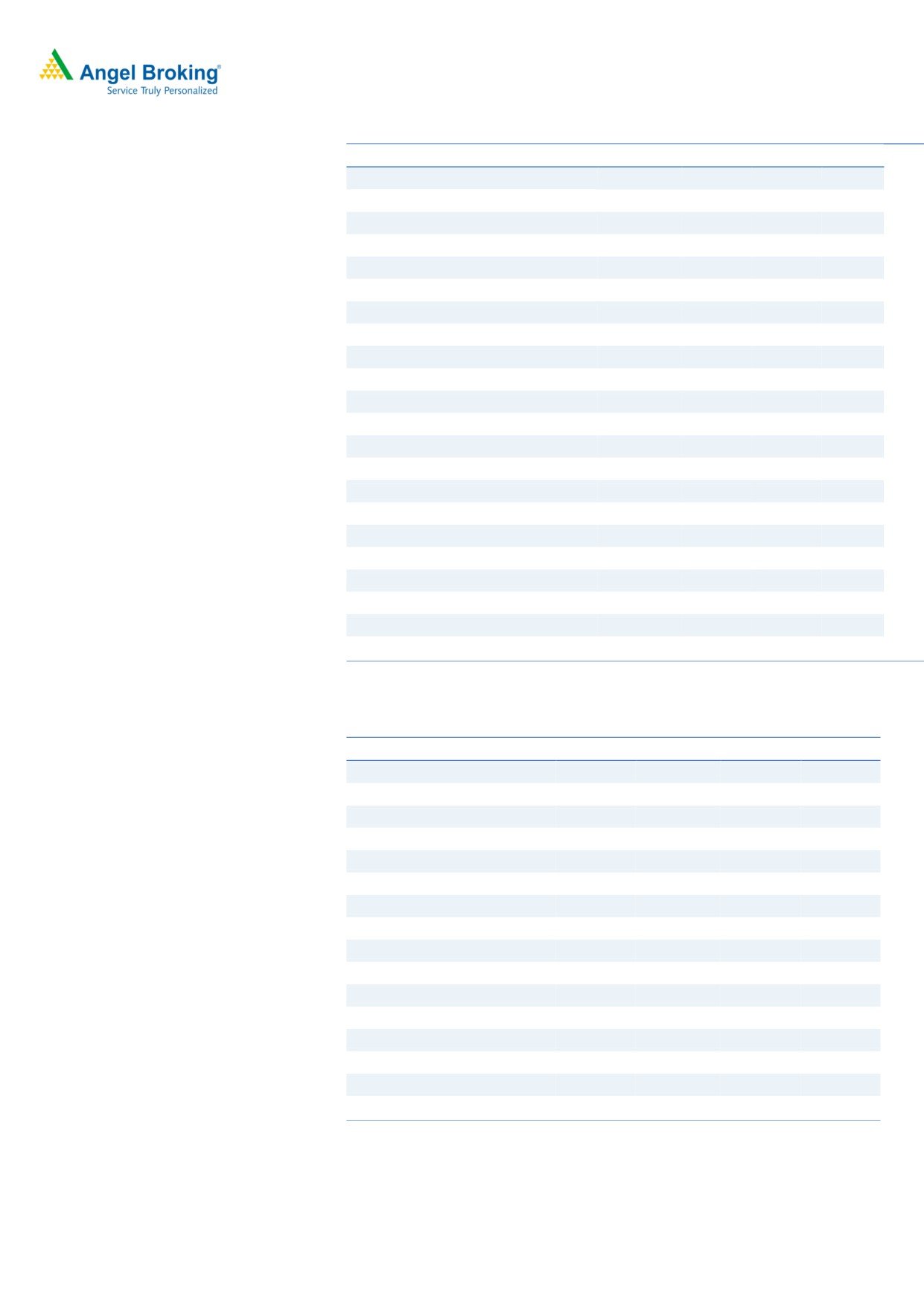

Balance Sheet

Y/E March (`cr)

FY18

FY19

FY20E

FY21E

SOURCES OF FUNDS

Equity Share Capital

9.4

9.4

9.4

9.4

Reserves& Surplus

353

426

502

596

Shareholders Funds

362

435

511

605

Total Loans

101

138

102

102

Other Liabilities

47

42

42

42

Total Liabilities

510

615

656

749

APPLICATION OF FUNDS

Net Block

532

549

599

639

Capital Work-in-Progress

34

49

49

49

Investments

88

81

78

93

Long Term Loans & Advances

4

5

5

5

Current Assets

562

465

542

657

Inventories

169

204

240

288

Sundry Debtors

318

221

266

320

Cash

2

2

12

5

Loans & Advances

1

1

1

2

Investments & Others

73

37

23

43

Current liabilities

721

574

642

743

Net Current Assets

-159

-109

-101

-86

Other Non Current Asset

11

40

25

49

Total Assets

510

615

656

749

Source: Company, Angel Research

Cash Flow

Y/E March (`cr)

FY18

FY19E

FY20E

FY21E

Profit before tax

98

134

129

149

Depreciation

48

60

63

68

Change in Working Capital

17

(132)

(123)

(67)

Interest / Dividend (Net)

8

16

16

16

Direct taxes paid

26

30

34

39

Others

(40)

(30)

(34)

(39)

Cash Flow from Operations

157

78

85

166

(Inc.)/ Dec. in Fixed Assets

(132)

9

(80)

(80)

(Inc.)/ Dec. in Investments

4

(4)

(12)

(28)

Cash Flow from Investing

(128)

5

(92)

(108)

Issue of Equity

-

-

-

-

Inc./(Dec.) in loans

19

36

-36

-

Others

(30)

(134)

52

(66)

Inc./(Dec.) in Cash

17

(15)

8

(7)

Opening Cash balances

1

19

4

12

Closing Cash balances

19

4

12

5

Source: Company, Angel Research

May 18, 2019

5

LUMAX Industries | Q4FY19

Key Ratio

Y/E March

FY18

FY19

FY20E FY21E

P/E (on FDEPS)

22.6

12.6

13.7

11.8

P/CEPS

12.3

8.0

8.2

7.3

P/BV

3.6

3.0

2.6

2.2

Dividend yield (%)

1.0

1.8

1.5

1.3

EV/Sales

0.8

0.8

0.7

0.6

EV/EBITDA

10.3

9.2

7.5

6.6

EV / Total Assets

2.4

2.5

2.4

1.7

Per Share Data (Rs)

EPS (Basic)

62

111

102

118

EPS (fully diluted)

62

111

102

118

Cash EPS

114

176

170

191

DPS

14

26

20

18

Book Value

387

465

547

647

Returns (%)

ROCE

19

16

20

20

Angel ROIC (Pre-tax)

22

19

24

24

ROE

16

24

19

18

Turnover ratios (x)

Inventory / Sales (days)

37

40

45

45

Receivables (days)

70

44

50

50

Payables (days)

119

75

70

70

Working capital cycle (ex-cash) (days)

-11

9

25

25

Source: Company, Angel Research

May 18, 2019

6

LUMAX Industries | Q4FY19

Research Team Tel: 022 - 39357800

DISCLAIMER:

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity & Derivatives

Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has

registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI

(Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been debarred/ suspended by

SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any

compensation / managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such

investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in

this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an

investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or

damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not

independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or

warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavors to

update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us

from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed

or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

Lumax Industries

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

May 18, 2019

7